COOLABAH Metals received a conditional letter of admission from the ASX this week regarding its acquisition of Broken Hill Mines Pty Ltd.

Coolabah has secured the extra $20m in capital required to begin trading publicly under the ticker “BHM” on or before July 22, at which point it will be rebranded as Broken Hill Mines.

The listing is part of the company’s massive relaunch as the new kid on the block in Broken Hill, with plans to explore the area’s silver, lead, and zinc resources.

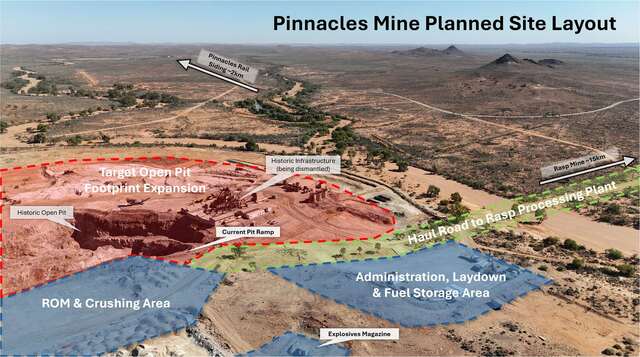

Coolabah acquired the Rasp mine from Japanese owner Toho Zinc in October last year, and has also entered into a profit share arrangement with the Williams family, who have owned the Pinnacles mine since the 1950s.

With Broken Hill Mines taking over operations on the two sites, it will be the first time in decades that the Broken Hill mines have returned to Australian ownership (the other significant mining company in Broken Hill, Perilya, is owned by Chinese company Shenzhen Zhongjin Lingnan Nonfemet Co. Ltd).

The rise of Broken Hill Mines, and the company’s impending float on the ASX, has been cause for chatter in the national media, with BHM CEO Patrick Walta describing the moment as something of a renaissance for Broken Hill.

“It’s pretty cool being able to say you’re operating the mine that started BHP,” Mr Walta told resource industry website, Stockhead, after the BHM prospectus launch last month.

“Every single person you talk to says, ‘My granddad worked there’, or ‘My auntie or my uncle was associated with Broken Hill’.

“Everyone in the mining community has a history with Broken Hill.

“And there’s a lot of patriotism there where they see this as really a story of national significance as much as anything else, about Broken Hill getting back into Aussie hands, being publicly listed, being transparent.”